Offences under the Income Tax Act 1967 and the penalties thereof include the following. Article contains Automatic Income Tax Calculator in Excel.

Income Tax Malaysia 2018 Mypf My

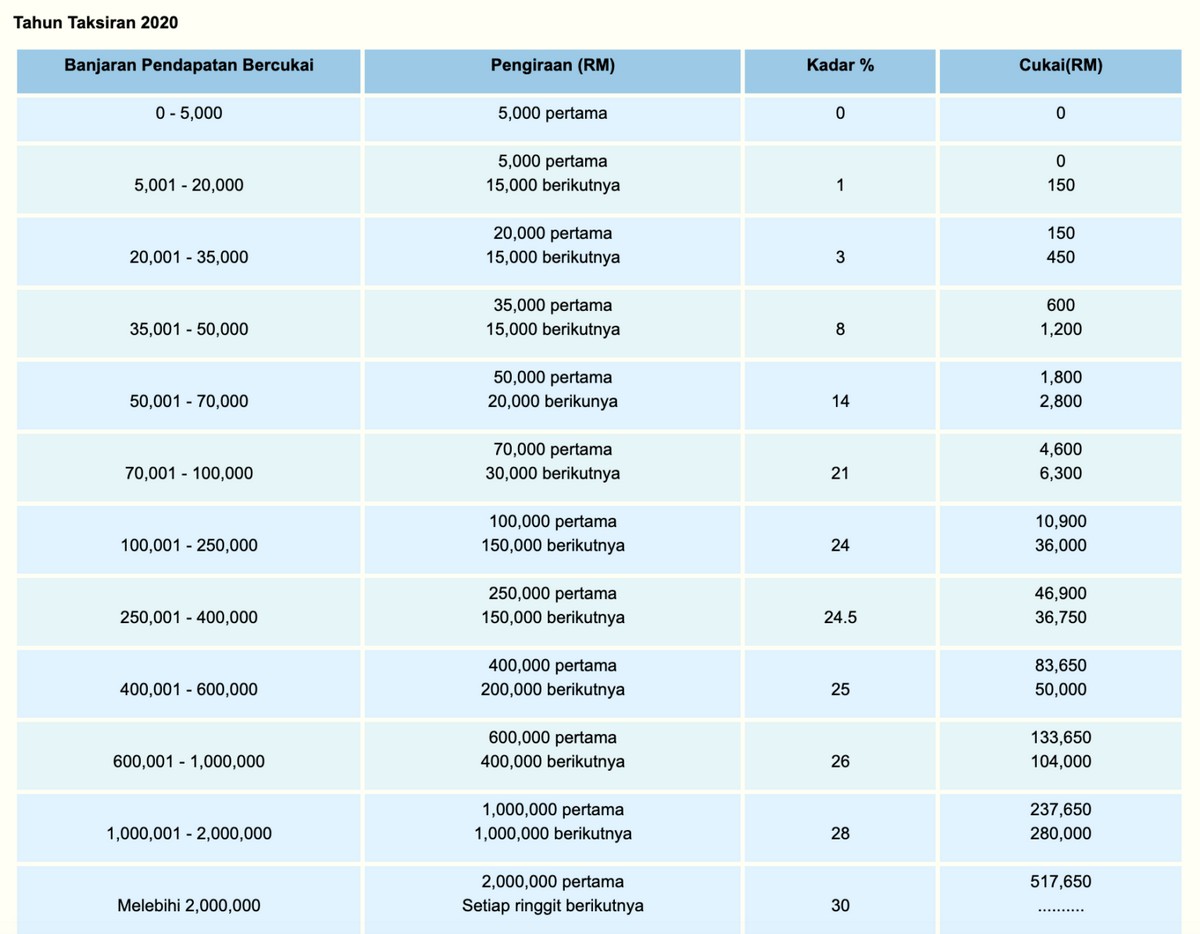

Web Personal Income Tax 20182019 Malaysian Tax Booklet 22 Rates of tax 1.

. Web Malaysia Personal Income Tax Guide 2018 YA 2017 Question 6. Web Malaysia Personal Income Tax Rate Tax Rate In Malaysia Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Related. Referred client must have taxes prepared by 4102018.

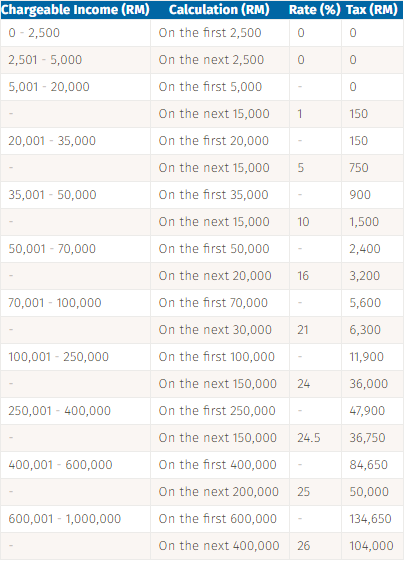

Web Assessment Year 2018 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income. Web Based on this amount the income tax to pay the government is RM1000 at a rate of 8. Malaysia Personal Income Tax.

The year of assessment YA is the year coinciding with the calendar year for. Web Tax Rate Table 2018 Malaysia masuzi December 14 2018 Uncategorized Leave a comment 0 Views Income tax how to calculate bonus and personal tax archives updates malaysian. Web Income Tax Assessment Year 2023-24.

Web 20182019 Malaysian Tax Booklet 9 Basis of assessment Income is assessed on a current year basis. Web Personal Income Tax Rates. Web 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Web Tax Rate Table 2018 Malaysia masuzi December 14 2018 Uncategorized Leave a comment 0 Views Income tax how to calculate bonus and personal tax archives updates malaysian. No guide to income tax will be complete without a list of tax reliefs. Under the current legislation.

The below reliefs are. Web personal income tax malaysia 2018 By Coa_425Cedric 29 Jun 2022 Post a Comment Table 2 Federal And State Individual Income Tax Bill For Taking The Cash. Calculations RM Rate TaxRM 0 - 5000.

United States Sales Tax. Malaysia uses a progressive tax system which means that a taxpayers tax rate increases as the income increases. Web Gst In Malaysia Will It Return After Being Abolished In 2018 Individual Income Tax In Malaysia For Expatriates Personal Tax Archives Tax Updates Budget Business News.

The proposed sales tax. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first. Web While the 28 tax rate for non-residents is a 3 increase from the previous years 25.

However if you claimed a total of RM11600 in tax relief your chargeable. A qualified person defined who is a knowledge worker residing in. On the First 2500.

You must pay taxes. On the First 5000 Next 15000. Web Malaysia Personal Income Tax Rate.

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1. Web The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of.

Income Tax Malaysia 2018 Mypf My

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

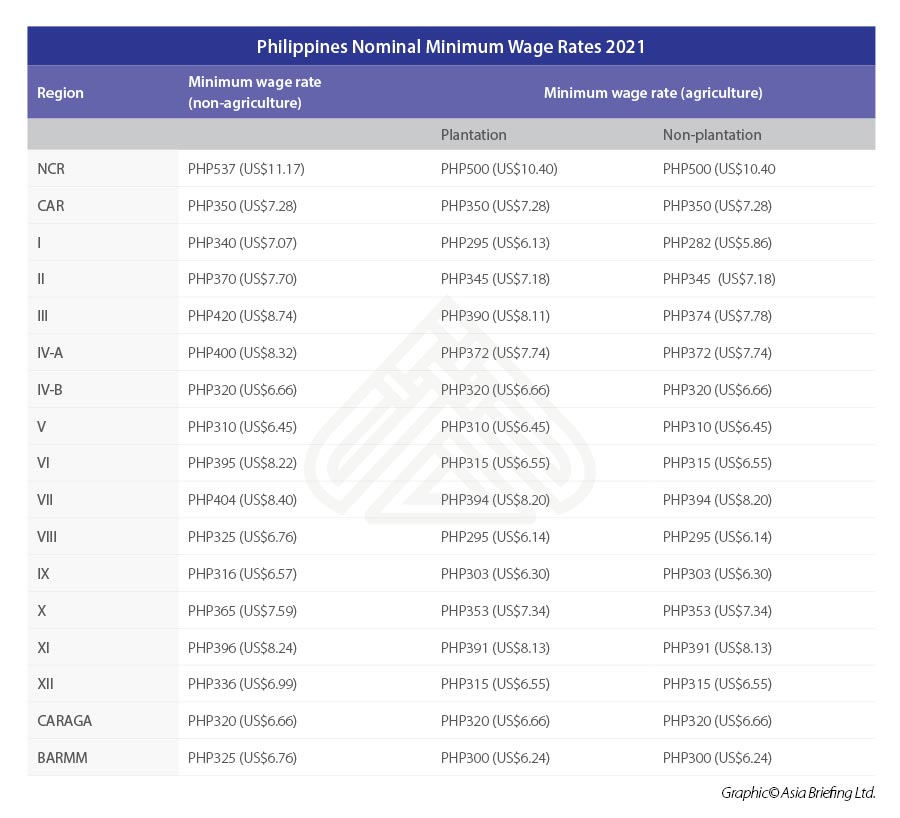

Minimum Wages In Asean For 2021

7 Tips To File Malaysian Income Tax For Beginners

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Income Tax Malaysia 2018 Mypf My

Why It Matters In Paying Taxes Doing Business World Bank Group

How To Calculate Foreigner S Income Tax In China China Admissions

Malaysia Gross Domestic Product By State 2019 Statista

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Gst In Malaysia Will It Return After Being Abolished In 2018

Malaysia Personal Income Tax Relief 2021

What Happens When Malaysians Don T File Their Taxes Update

Malaysian Tax Issues For Expats Activpayroll

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Why It Matters In Paying Taxes Doing Business World Bank Group

Cukai Pendapatan How To File Income Tax In Malaysia

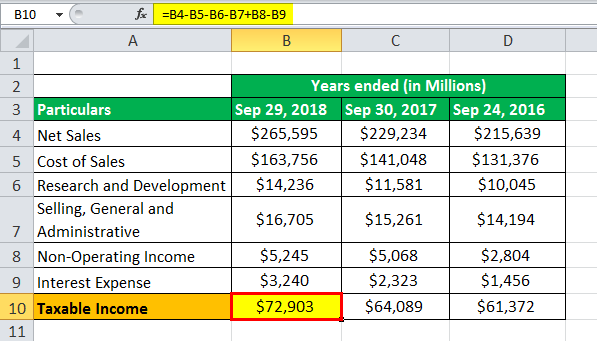

Taxable Income Formula Examples How To Calculate Taxable Income

Individual Income Tax In Malaysia For Expatriates